Homeowners Insurance in and around Sacramento

Sacramento, make sure your house has a strong foundation with coverage from State Farm.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Elk Grove

- Sacramento

- Roseville

- Carmichael

- Orangevale

- Rocklin

- Folsom

- El Dorado Hills

- West Sacramento

- Woodland

- Davis

There’s No Place Like Home

None of us can see what we will encounter in the future. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance doesn't just protect your house. It protects both your home and the things inside it. In the event of a tornado or falling trees, you may have damage to some of your belongings on top of damage to the actual house. Without insurance to cover your possessions, you won't get any money to replace your things. Some of the things you own can be protected from theft or loss outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

Sacramento, make sure your house has a strong foundation with coverage from State Farm.

Apply for homeowners insurance with State Farm

Open The Door To The Right Homeowners Insurance For You

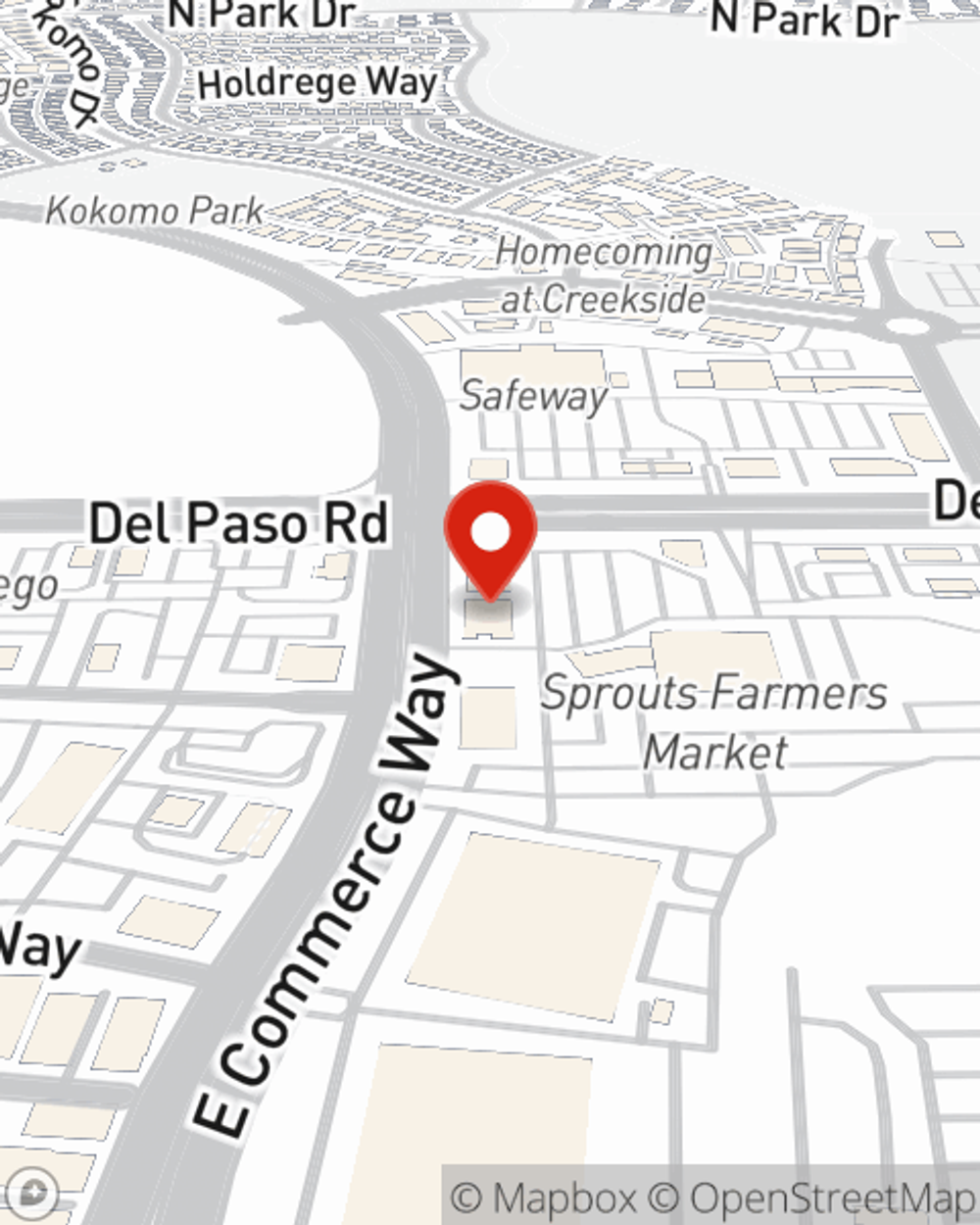

Fantastic coverage like this is why Sacramento homeowners choose State Farm insurance. State Farm Agent Monique Ambers can offer coverage options for the level of coverage you have in mind. If troubles like identity theft, drain backups or service line repair find you, Agent Monique Ambers can be there to help you file your claim.

As your good neighbor, State Farm agent Monique Ambers is happy to help you with getting started on a homeowners insurance policy. Call or email today!

Have More Questions About Homeowners Insurance?

Call Monique at (916) 928-4747 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Safety tips for food spoilage

Safety tips for food spoilage

Whether you’re experiencing a power outage or left some food out for a while, here are some safety tips to help avoid consuming spoiled food.

Monique Ambers

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Safety tips for food spoilage

Safety tips for food spoilage

Whether you’re experiencing a power outage or left some food out for a while, here are some safety tips to help avoid consuming spoiled food.